October 26, 2015

Dear Valued Client Partner,

As a follow-up to my correspondence of July 31st, I’d like to update you regarding the liquidation of A&P, the anticipated redistribution of sales revenues and market share across the Metro New York marketplace, and how the RDD service model is evolving to these changes.

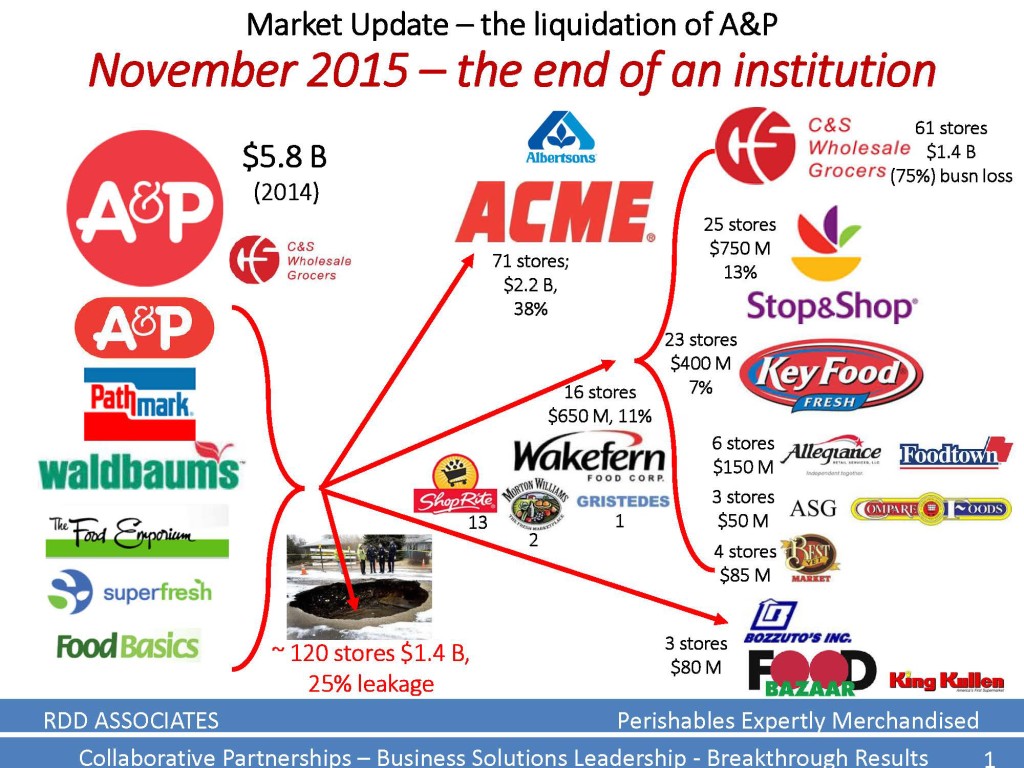

Although the A&P family of banners, to include A&P, Pathmark, Waldbaums, The Food Emporium, SuperFresh and Food Basics, has experienced significant sales erosion for several years, it still accounted for approximately $5.8 B sales revenues in 2014, representing over 7% of total grocery store sales in the Metro New York/Mid-Atlantic region. With most of the store divestitures and auction sales now approved by the bankruptcy court with re-bannering activities scheduled and initiated, and the remaining stores liquidating inventories and scheduled for closure within weeks, we now have a clearer picture of what the marketplace will look like in early 2016. For your reference, I’ve attached a one-page document that captures the essence of the liquidation, and here are the major headlines:

- ACME, a division of the new Albertson’s, will again become a significant factor in Metro New York grocery, with 72 locations, $2.2 B in sales and a 6.5% Metro NY market share

- Stop & Shop – New York, a division of Ahold USA, will add 25 locations, increasing their store count to 210, $7.7 B in sales, and a 23% market share

- Key Food Cooperative will add 23 locations, increasing their store count to 207, with estimated sales of $2.3 B and a 7% market share. For the first time the co-op will own and operate stores (2) as corporate units

- Wakefern Food Corporation will add 16 stores to their service roster, including 13 in the ShopRite family and 3 as wholesale customers

- Allegiance Retail Services, the member cooperative managing Foodtown, will add 6 new locations from A&P, and reportedly their member/owners will be opening an additional 4 new supermarkets, resulting in estimated sales in 2016 of $1.3 B and a 4% market share

- C&S Grocers will experience a significant decline in Metro New York business, down approximately 75%. In addition to the units going to Stop & Shop and Key Food, approximately 10 stores will be re-bannered as independents and will continue to be supplied by C&S

- It now appears that over 100 former A&P stores will cease to operate as grocery stores, and will either become alternative channel retailers or exit retailing completely. These stores accounted for approximately 25% of A&P’s sales, and this business will “leak” into existing grocery retailers of alternative channels

RDD is currently assisting all of the growing chains with store re-bannering activities, to include shelf management and reset facilitation. It appears that the majority of divested stores will complete transitioning over the next 6-8 weeks.

RDD has adjusted our go-to-market strategy by redeploying personnel resources, relative to both retail (in-store) and headquarters coverages, to insure that we maintain appropriate merchandising service levels and capitalize on every business-building opportunity to build sales volumes at the expanding chains.

The supermarket industry merger and acquisition activities continue to be very active, so it is critically important that RDD continues to expand our regional capabilities to serve client-principals with the “perishables-exclusive” service portfolio that provides competitive sales and merchandising advantage. As you are aware, Ahold and Delhaize have announced an agreement to merge their companies, creating the 3rd ranking supermarket company in the U.S. with over 2,100 stores and $49 B in sales. For your awareness, they have yet to share with trading partners their operational roadmap for the merged company, however a transition committee has been named and we anticipate communications will begin before the end of the calendar year. Meanwhile, RDD continues to proactively engage in discussions with several perishables-focused, southeast U.S.-based sales agencies, to provide network retail coverage for the new Ahold Delhaize if appropriate.

Finally, RDD continues to collaborate with our regional sales agency alliance partners, STAR/Pro-Star and MATRIX, to operationalize RSM – Regional Sales Solutions. Expanding upon our successful Ahold vertical service solution platform, RSM provides clients the opportunity for seamless regional sales agency coverage at Ahold USA (Stop & Shop’s and Giant’s), the new Albertsons (ACME, Safeway and Shaw’s), Wakefern (ShopRite and Price Rite), C&S Wholesale Grocers and Bozzuto’s Inc., with continued traditional penetration of all local market area chains and independents. I encourage you to schedule a visit with the RDD leadership team to learn more about our unique service solution.

The RDD leadership team remains fully engaged and totally committed to sustain our leadership position by delivering client and customer trading-partners value-added solutions that address industry challenges and capitalize on marketplace growth opportunities. We will continue to closely monitor industry dynamics, and will keep you apprised of any further changes. We have the talent, tools, traditions, aspirations, energy and the adaptability to succeed on your behalf!

Thank you again for your continued support, encouragement and trading-relationships.

Best regards,

Bob Cignarella